Negative interest rates and what it means

| August 12th, 2016 at 7:55:29 PM permalink | |

| Pacomartin Member since: Oct 24, 2012 Threads: 1068 Posts: 12569 |

The article states: So far, policy makers have said there havenít been any serious negative side-effects, such as customers withdrawing their cash and stashing it elsewhere. I see that the 500 Euro note circulation numbers have been reduced by 7.7% in 6 months since December when the announcement was made that the denomination would not be included in future printings. The government will have to do better than that to prevent "stashing". New series of banknotes (the Europa series)  Sweden charges commercial banks negative interest rates on all cash (not just large deposits). As you can imagine banks avoid handling cash like it has plague. The cash in circulation drops every month: Change in currency per person in Swedish cash (converted to US dollars) Dec 31, 2014 Oct 30, 2015 -$108 Nov 30, 2015 -$23 Dec 31, 2015 +$14 Jan 31, 2016 -$55 Feb 29, 2016 -$16 Mar 31, 2016 -$10 Apr 30, 2016 -$6 May 31, 2016 -$10 Jun 30, 2016 -$22 Jul 31, 2016 -$2 I don't know if the minimal $2 last month is a change in policy or a statistical glitch.It is no secret that Sweden does not want it's cash going to other European countries where it used as a hedge investment. Banknotes in Sweden are circulating at around $700 per person. Banknotes in USA are circulating at $925 per person for $1 to $50 denomination, and $3,600 per person in the $100 denomination. Total value of banknotes from $1 to $50 has increased basically at the same as population rate and inflation rate increased. The Benjamins are increased at a rate far above population and inflation. Overseas circulation may explain some, but not all the popularity of the Benjamin. |

| August 13th, 2016 at 2:56:45 AM permalink | |

| AZDuffman Member since: Oct 24, 2012 Threads: 135 Posts: 18210 |

This is also still kind of new. Some people may think it will not last, others hardly noticing. But eventually it has to cause some kind of behavioral change. I still maintain that the biggest danger is when it gets to the point that cash cannot sit anywhere without a "charge" for doing so. That the creditor gets the interest is as old as banking itself. Somethings gotta give. The President is a fink. |

| August 13th, 2016 at 8:17:50 AM permalink | |

| Pacomartin Member since: Oct 24, 2012 Threads: 1068 Posts: 12569 |

Well the article refers to accounts over 100,000 Euros, which is limited in scope. But the commercial bank is also serving notice that if the ECB extends the rate to all money, then the commercial bank will simply pass along costs to consumers. Both Switzerland and Sweden have been at this for longer than the ECB or Japan. Sweden dropped it's Deposit rate % to zero on 18 December 2013. So if banks store cash with the Central bank overnight, they no longer receive interest. Cash becomes even more of a liability than it normally is, because now a commercial bank has to store it themselves, or transfer it to the central bank but to receive no revenue. On 9 July 2014 Sweden went into negative rates on deposits. So now the commercial bank really is motivated to get rid of cash. The regulations were changed so that the commercial banks are no longer required to hold onto cash. Banks stop doing over the counter cash transactions.

Although the central bank had been reducing banknotes in circulation since 2007, these changes greatly accelerated the reduction in the value of banknotes. The banks were highly motivated to develop person to person phone apps to make it easy to do private electronic transfers. Many Swedes give up carrying cash completely. Valid Banknotes Million Swedish Krona 55,984 July 2016 68,139 2015 77,887 2014 80,294 2013 91,056 2012 94,771 2011 99,902 2010 104,590 2009 106,266 2008 108,517 2007 The current Swedish banknotes in circulation amount to roughly US$700 per person. USA is circulating roughly $930 per person in the $1 to $50 denomination, but over $3600 per person in the $100 denomination. Right now the ATM withdrawals in Sweden are fairly large, with up to roughly US$1000 per week, nothing like the capital controls in Greece.

There is an activist group in Sweden called "cash uprising" that is trying to alert people of this danger. But mostly they are ignored. The 1000SEK banknote has the equivalent purchasing power of US$100 has almost vanished. Many people simply say the 1000SEK banknote is for old people. The 500SEK banknote represents 73% of the value of banknotes in circulation. The government begins issuing a new 500SEK banknote on 1 October 2016 and the old banknotes expire in 2017. The big question is how many will they print? |

| August 13th, 2016 at 10:42:41 AM permalink | |

| AZDuffman Member since: Oct 24, 2012 Threads: 135 Posts: 18210 |

They will keep getting ignored until it is too late, same as every other time some group tries to warn people. I try to warn people about this. The ones that understand do not need warned. The ones who do not understand don't care. But I still maintain that there is a bigger problem out there. Namely, the system in place the last 1-200 years might be breaking forever. If low rates no longer stimulate, then what? Of course we will figure it out, but much pain in the meantime. Japan has had 25 years of this. Infrastructure spending will only do so much. The President is a fink. |

| August 13th, 2016 at 11:26:44 AM permalink | |

| Pacomartin Member since: Oct 24, 2012 Threads: 1068 Posts: 12569 |

Somebody said to me once "What goes up must come down!", as if laws of economics were the same thing as laws of physics. They seemed surprised that I would take issue with such an obvious statement. Prior to the Meiji Restoration, Japan's feudal fiefs all issued their own money, hansatsu, in an array of incompatible denominations, essentially they were governed by the feudal system that existed in Europe in the middle ages. The New Currency Act of 1871 (145 years ago) did away with these and established the yen, which was defined as 1.5 g (0.048 troy ounces) of gold, or 24.26 g (0.780 troy ounces) of silver, as the new decimal currency. The current price of gold is ¥4,352.23 per gram or a devaluation of 99.985% of the yen. That is actually higher devaluation in 145 years than the 99.892% devaluation of the Pound Sterling since it's origins in the reign of King Offa of Mercia, (757Ė796) who introduced the silver penny. So sometimes I think that it is not wholly inconceivable that we could return to fiefdoms. |

| August 13th, 2016 at 12:37:23 PM permalink | |

| AZDuffman Member since: Oct 24, 2012 Threads: 135 Posts: 18210 |

Bitcoin at the least will visit for a while longer. Anyone could make a gold-backed currency, trust would be hard. Some small towns have made parallel currencies. Some trade groups have popped up to exchange services. Car wash for dry cleaning. None of it taxable if you do it that way. Has to be big enough group and has to be accepted. If everyone wants car washes but the car wash wants no dry cleaning then there is a problem. The President is a fink. |

| August 13th, 2016 at 3:46:42 PM permalink | |

| Pacomartin Member since: Oct 24, 2012 Threads: 1068 Posts: 12569 |

Organized Anonymous Barter is not really a new idea.

|

| August 26th, 2016 at 2:49:53 AM permalink | |

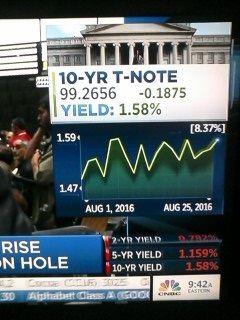

| odiousgambit Member since: Oct 28, 2012 Threads: 154 Posts: 5105 | The Fed has pundits expecting a hike, maybe September, but many think not until December. There's a statement expected today from the Jackson Hole meeting that might shed light. Mighty slow change. I reduced my bond exposure more than I should have, expecting a rate increase before now. That the 10 year should be allowed to be so shy of 2% for so long is nothing short of amazing. Bonds went up during this decrease, good time to sell and then buy again when they get cheaper, but it winds up being a waste of time if they stay down like this. If you find it all very confusing, don't feel bad. I notice CNBC will show the same statistic in green [meaning good for bonds] and also in red [meaning bad] on the same screen sometimes. I finally caught it with a pic, the 1.58% for the 10 yr in green up top for current commentary while the revolving ticker down below is showing it in red. Red is usually considered correct, as the interest rate is going up since bonds are being sold a bit in front of this Jackson Hole business. Whoever is doing the upper graph is confused, going up must be good, right? Not if you want to sell your bonds LOL  I'm Still Standing, Yeah, Yeah, Yeah [it's an old guy chant for me] |

| August 26th, 2016 at 3:04:39 AM permalink | |

| AZDuffman Member since: Oct 24, 2012 Threads: 135 Posts: 18210 |

Very hard to say where we are going. GDP growth is way flat. Subprime auto loan defaults are starting to bite, and sales of big rigs are crashing. I do think way more people than anyone realizes have still not recovered from the Panic of 2008. Meanwhile, equities keep humming along. I pulled back to safety last fall, not about to lose half my IRA like last time. But I keep looking and wondering. Maybe fall brings the crash? Just let mortgage rates stay low and pass HARP III. Then I can ride it out. The President is a fink. |

| August 26th, 2016 at 4:51:03 PM permalink | |

| Fleastiff Member since: Oct 27, 2012 Threads: 62 Posts: 7831 | Already one can find scattered news stories about businesses refusing to accept cash. No cash, no cash drawers, no errors in change, no tempting targets, no need for clerks to know how to add, no sticky fingered clerks, no trips to the bank. Pay by card or get lost. |